The Association of Chartered Certified Accountants (ACCA) was founded in 1904 and is the fastest growing global body of professional accountants in the world, helping people across the globe to become successful finance professionals. ACCA is one of the most widely recognised international certifiers for finance and controlling professionals, with more than 200 thousand members and 500 thousand students around the world.

The Programme

The programme contains 13 rigorous exams in the English language, divided into three successive levels, ACCA Diploma in Accounting and Business, ACCA Advanced Diploma in Accounting and Business, and ACCA Strategic Professional. The exams cover business and technology, performance management, financial reporting, business law, audit and assurance, taxation and financial management, and allow students to earn the Bachelor of Science (Hons) Applied Accounting from Oxford Brookes University, as well as the Master of Science Professional Accountancy at the University of London, in addition to the ACCA Qualification.

The Roadmap

To make progress on your studies is importante to follow the classes and sit the exams on the proper date. Check our complete roadmap for 2023 with the dates of the classes, mock exams and number of hours here.

| Part-qualified | Full-qualified | |||

|---|---|---|---|---|

| ACCA Qualification | ACCA Diploma in Accounting and Business Applied Knowledge |

ACCA Advanced Diploma in Accounting and Business Applied Skills |

ACCA Strategic Professional 3 years of exeperience on a relevant work field |

|

| Exams | Business and Technology Management Accounting Financial Accounting (IFRS) + Online module on ACCA Foundations in Professionalism |

Business Law Performance Management Taxation Financial Reporting (IFRS) Audit and Assurance Financial Management + Online Module on Ethics and Professional Skills |

Strategic Business Leader Strategic Business Reporting (IFRS) e 13. Two to choose between Advanced Performance Management, Advanced Financial Management, Advanced Taxation, Advanced Audit and Assurance |

|

| Requirements for entry | High school Diagnostics tests Intermediate english |

Diagnostics tests Advanced english Exemption or aproval on ACCA Diploma in Accounting and Business exams |

Diagnostics tests Advanced english Exemption or aproval on ACCA Diploma in Accounting and Business e do ACCA Advanced Diploma in Accounting and Business Online module of ACCA Ethics and Professional Skills Fill out the PER |

|

| Opcional | + Bachelor of Science (Hons) Applied Accounting da Oxford Brookes University | + Master of Science Professional Accountancy da University of London | ||

| Orientation to OBU Research and Analysis Project (RAP) Updated fees neste link |

2 modules of 30 crcredits or 4 modules of 15 credits (12 months of online training with SHP and University of London) Updated fees neste link |

|||

| SHP Traning | ACCA Registration Online mentoring sessions Follow up with the students during the roadmap |

|||

| Exemptions | According to number of exemption the number of instalments can change. Check the updated fees here.. | |||

| ACCA's fee | All ACCA's fees can be found here. | |||

| SHP Accelerator Programme | Your instalments can be based on 15% of your revenue until the total of the course is paid. For more information get in touch with us here. | |||

The ACCA Qualification is an internationally recognised professional development programme equivalent to a UK master’s degree. Students who successfully complete the qualification are admitted as members of the ACCA. The qualification is recognised in 176 countries, including: United Kingdom, Germany, Canada, Italy, New Zealand, Malaysia, Portugal, and Singapore. Students can also obtain a bachelor’s degree from Oxford Brookes University in the United Kingdom and a master’s degree from the University of London in addition to the ACCA Qualification by completing additional modules.

The ACCA Qualification is a hard thing to achieve. Holders of the qualification are recognized in business for their technical proficiency, digital, sustainability and strategic leadership skills. ACCA Members have privileged status in law and the ACCA Qualification is formally recognised by UK, European and other academic regulators and national accounting bodies.

ACCA is one of the five most widely recognised accounting qualifications.

Under Section 389 of the UK Companies Act 1985, a person is not qualified for appointment as auditor of a company unless a member of:

(a) the Institute of Chartered Accountants in England and Wales (ICAEW),

(b) the Institute of Chartered Accountants of Scotland (ICAS),

(c) the Association of Chartered Certified Accountants (ACCA),

(d) the Institute of Chartered Accountants in Ireland (ICAI).

Click here to see the UK qualification framework recognition.

The equivalent qualification in the United States is the Certified Public Accountant (CPA) license. Most States require the CPA to provide attestation (including auditing) opinions on financial statements.

Academically, the study required for achieving full ACCA Qualification is assessed at 5,100 Notional Training Hours. The ACCA Advanced Diploma in Accounting and Business is recognized by UK and European Academic Registration Boards as equivalent to a Bachelor’s Degree (BSc.) and the ACCA Strategic Professional Certificate is recognized as equivalent to a Master’s Degree (MSc.). Because ACCA receives academic as well as professional recognition, students can also obtain a Bachelor of Science degree from Oxford Brookes University and a Master of Science degree from the University of London in synergy with the ACCA Qualification.

The academic synergy and contractual partnership between ACCA and the universities greatly reduces the time and cost of obtaining these degrees. So, if you are thinking of studying for a Bachelor´s degree in accounting, or a Master’s degree, this programme could be perfect for you!

ACCA and Oxford Brookes University have worked together to develop a Bachelor’s Degree in Applied Accounting, which is available exclusively to ACCA students who wish to earn a degree while studying for the ACCA Qualification. Students in Brazil can obtain this degree through SHP Financial Training & Recruitment.

There are many benefits to completing the course, the main one being a degree and a professional accounting certification are a powerful combination of certifications to have, putting you in demand with employers and improving your career prospects. This is a once in a lifetime opportunity

Steps

Step 1 – Matriculation

Step 2 – ACCA Knowledge Exams (passes/exemptions)

- Accountant in Business (AB), Management Accounting (MA), and Financial Accounting (FA).

Step 3 – ACCA Skills Exams

- Passes/exemptions: Business Law (LW), Performance Management (PM), Taxation (TX),

- Passes: Financial Reporting (FR), Audit and Assurance (AA), Financial Management (FM).

Step 4 – ACCA Ethics and Professional Skills module.

Step 5 – Oxford Brookes University Research and Analysis Project

- Submit and pass the distance mentored Oxford Brookes University Research and Analysis Project. SHP Financial Training provides mentoring for this project.

To stand out in a competitive market, ACCA students receive the unique opportunity to earn the Master of Science Degree in Professional Accounting from the University of London in addition to their ACCA Qualification. Students in Brazil can obtain this master’s degree through SHP Financial Training. After completing the following five steps, students gain both the ACCA Qualification and the Master of Science Degree in Professional Accounting from the University of London.

Steps

Step 1 – Matriculation

Step 2 – ACCA Knowledge Exams (passes/exemptions)

- Accountant in Business (AB), Management Accounting (MA), and Financial Accounting (FA).

Step 3 – ACCA Knowledge Exams (passes/exemptions)

- Business Law (LW), Performance Management (PM), Taxation (TX), Financial Reporting (FR), Audit and Assurance (AA), Financial Management (FM).

Step 4 – ACCA Strategic Professional Essentials

- Four preparation courses (material included) offered online or face-to-face in São Paulo: Strategic Business Leader (SBL), Strategic Business Reporting (SBR), Advanced Performance Management (APM) and Advanced Financial Management (AFM).

- Ethics and Professional skills online module.

Step 5 – Master’s in Professional Accountancy from the University of London

- Pass two 30-credit modules or four 15-credit modules offered through the University of London with local support from SHP.

Click here for more information

Professionals who aim to work in finance and accounting and want to take on leadership positions in large / multinational organisations both within Brazil and abroad. All types of business need professionals who understand finance and accounting, talented people who can help make the business a success. The ACCA Qualification provides the skills and knowledge relevant to any area, allowing you to choose your career direction.

SHP Financial Training & Recruitment is the only ACCA Gold Learning Partner in Latin America and offers online preparatory courses for ACCA exams. The teaching material is in English and classes are taught in both Portuguese and English.

There are three levels of certification that can be obtained on the journey to becoming ACCA qualified:

- ACCA Diploma in Accounting and Business. Duration: approximately 6 months or until the student gets the necessary knowledge to progress to the next phase. Students who are not fluent in English will need more time to build up language skills alongside their technical knowledge.

- ACCA Advanced Diploma in Accounting and Business (optional: Undergraduate degree in Applied Accounting from Oxford Brookes University in the United Kingdom). Duration: From 15 to 18 months (may vary depending on any exam exemptions the student has).

- Strategic Professional (optional: Master’s in Professional Accountancy from the University of London in the United Kingdom). Duration: 12 months.

The total duration of the programme, including all three levels, is 5,100 notional hours of learning, including hours of classroom learning, home study, on-the-job learning (professional experience), exam preparation time and exam time.

This is a Study Funding Programme for the Professional Development Program SHP – ACCA – Oxford Brookes University – University of London, in Premium format.

With this benefit, the installments will be smaller, the due dates longer and without interest so that you can invest in your career without weighing your pocket.

You can secure an international qualification that will provide a leap in your professional life.

Get ready to work in the leadership of large companies, multinationals and abroad. Invest in a quality education, invest in yourself.

Requirements to guarantee your participation on SHP Accelerator Programme:

1. Perform all quizzes, progress tests and simulations on the platform provided by SHP.

2.View all content available on the platform.

3. Absence from the real exam in case of failure in the final simulated.

Payment method:

The tuition fee will be based on 15% of the monthly net income until the course fees are paid.

With the SHP Certificate you have 3 great advantages:

• Participation on the SHP Accelerator Programme Study Funding

• Points for Continuing Professional Education on CRC;

• Access to the Pass Guarantee with updated syllabus

Benefit requirements:

1. Perform all quizzes, progress tests and simulations on the platform provided by SHP.

2. View all content available on the platform.

3. Absence from the real exam in case of failure in the final simulated.

Students may receive exemptions from some exams depending on their academic background, which will decrease the number of hours needed to complete the programme. Exemptions are not awarded for work experience.

Students with an accounting or finance degree should receive exemptions from the first 3 or 4 of the 13 exams. Graduates of degree courses accredited by ACCA may be eligible for additional exemptions as follows:

- PUC-SP – Bachelor of Accounting – 9 exam exemptions

- Universidade de São Paulo – Bachelor of Accounting – between 4 and 9 exam exemptions depending on modules studied

- FIPECAFI – Bachelor in Accounting – between 4 and 5 exam exemptions depending on modules studied

- Universidade Mackenzie – Bachelor in Accounting – between 4 and 5 exam exemptions depending on modules studied

- FGV – Mestrado Profissional em Gestão para Competitividade – Finanças e Controladoria – 9 exam exemptions for students graduated between 2017 December 2021

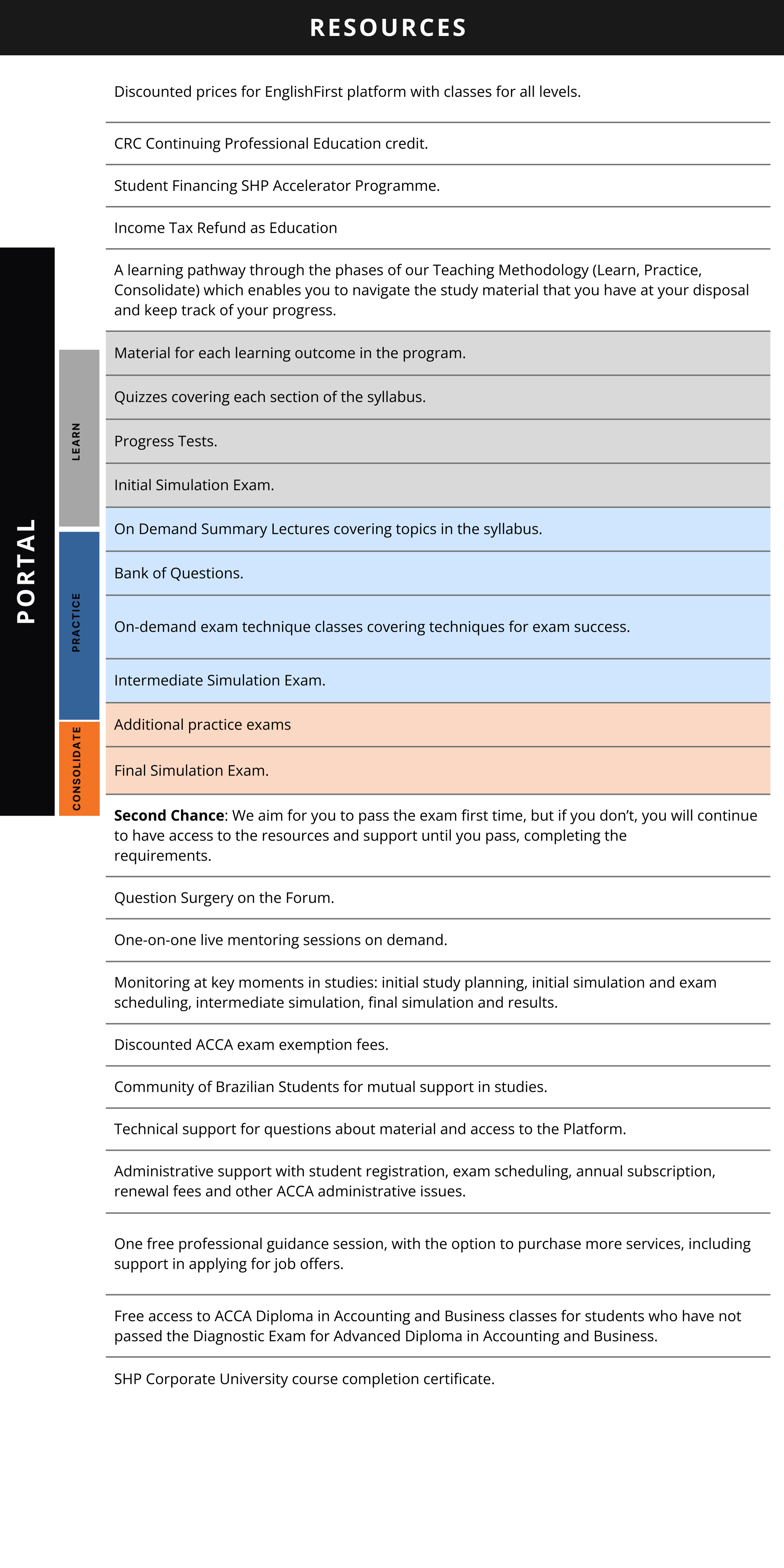

- Learn – interactive teaching classes focused on applying knowledge to exercises.

- Practice – intensive question practice and exam technique guidance.

- Consolidate – progress tests and practice exams with mentoring and debrief classes.

Resources and Support provided by SHP to course participants